Consumer confidence down in June

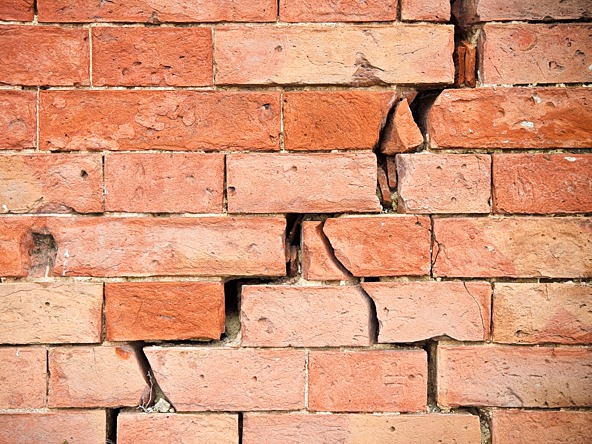

Consumer confidence declined from 103.3 to 101.6 with homeowners’ perceptions of property values for the past 30 days slumping from 113.2 to 107.4 (-5.8 ), while outlook for the year ahead crashed from 118.5 to 108.2 (-10.3 ).

The latest results as rising interest and mortgage rates lead to a cooling in the housing market amid a cost-of-living crisis across the UK.

YouGov and the Cebr found that scores for household finances over the past 30 days worsened from 79.8 to 78.7 (-1.1 ) – the first time they have fallen since October 2022.

However, views of performance over the next 12 months saw a modest improvement from 80.6 to 81, albeit still in negative territory, with scores above 100 deemed ‘positive’.

The data also shows that employees were slightly less positive about their job security for the past months at 94.4, down from 94 in May.

Despite this, perceptions for the next 12 months jumped from 112.1 to 114.6 (+2.5 ). and workers also perceived mild improvements in business activity in the past month, which increased from 108.8 to 109.5.

Outlook of the performance of their business over the year ahead rose from 118.8 to 119.4 (+0.6 ), according to YouGov and the Cebr.

Kay Neufeld, director and head of forecasting and thought leadership at Cebr, said: “With inflation falling less quickly than anticipated, expectations for peak interest rates have shot up leading to a spike in borrowing costs.

“This will especially be felt by those trying to buy a house or having to remortgage at rates that have now surpassed those seen in the wake of last year’s mini-budget.

“Looking for bright spots in this month’s set of data shows that the business activity and job security scores held up reasonably well and overall confidence remains in positive territory for now.”

We hope you enjoyed this article.

Research Live is published by MRS.

The Market Research Society (MRS) exists to promote and protect the research sector, showcasing how research delivers impact for businesses and government.

Members of MRS enjoy many benefits including tailoured policy guidance, discounts on training and conferences, and access to member-only content.

For example, there's an archive of winning case studies from over a decade of MRS Awards.

Find out more about the benefits of joining MRS here.

0 Comments