AI has broken the research agency model: What comes next?

Over the past two years, the research industry has faced an existential threat: the democratisation of data collection and analysis. Tasks once requiring specialist teams, long timelines and large budgets can now be done client-side by one person using modern tools at a fraction of the cost and in a fraction of the time.

This shift has disrupted the traditional value equation and raised a key question: if anyone can collect and analyse data, where does a research agency’s value lie?

Many agencies still rely on cost-plus models built on layers of people and processes. At best, these deliver rich, expert insight; at worst, they’re slow, expensive and inefficient.

AI has upended this model, creating value by removing layers to boost efficiency but often at the cost of depth. New tech entrants offer speed and scale, yet risk producing ‘AI slop’: high volume, low substance work.

While clients may accept ‘good enough’ results for low-risk projects to save time and money, agencies feel growing pressure to cut prices in response.

But to avoid a short-termist race to the bottom, this disruption can equally be seen as an invitation to recalculate the value equation around what the market is clearly showing matters most in the perception of value: depth and speed.

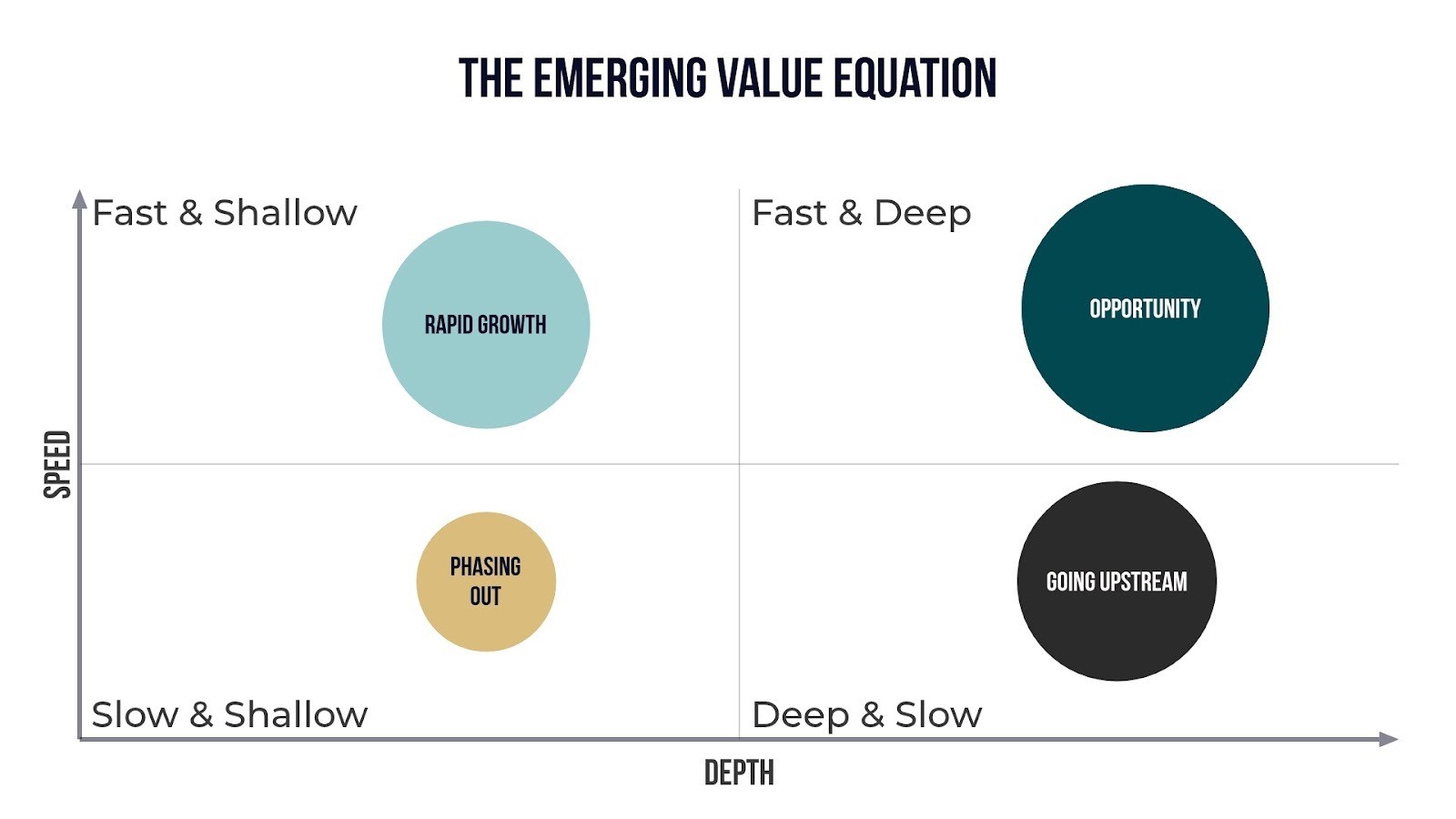

The following quadrants show how these two key drivers of value relate to each other and shape the current market:

1 ) Shallow and slow: The dead zone

This is the part of the market that used to survive by doing the basics: data collection, simple analysis, templated reports. Without the value add of strategic insight or operational agility, this quadrant now has too little left to offer. The time it once sold is now a cost clients aren’t willing to pay. This end of the market is being phased out and that’s no bad thing.

2 ) Shallow and fast: The automation boom

This is where most of the excitement and most of the noise is happening. New AI and digital research tools are making it easy to spin up surveys, test creative, or get directional feedback in a few clicks. For simple, low-risk projects, this quadrant saves significant time and money, which is why it’s growing.

However, too often teams are also finding that they can’t always trust the outputs or that this approach can’t solve the more complex problems they need to solve.

There is also the risk of creating a ‘research Jevons Paradox’: as research becomes more efficient, it’s used more, devalued and yields fewer insights. Clients may buy cheaper research more often, maintaining spend but reducing impact. Over-reliance then leaves teams drowning in data yet starving for meaning.

3. Deep and slow: The craft legacy

This is the home of traditional research craft. It’s where you go when the stakes are high and the questions are hard. However, it’s also expensive, often slow and increasingly out of step with how modern teams want to work. Its strength, human expertise, is also its limitation if that expertise can’t be delivered faster or more flexibly.

This is the quadrant where the best work has traditionally happened; work that can be trusted, that opens up opportunities to be surprised and gets to the heart of things. This area will always be valued and as competition grows there will be a drive to add more value further upstream, and in new and deeply human ways. Great news for clients and the industry alike.

4. Fast and deep: The augmented advantage

This is a major opportunity to redefine how value is created. Desk research that once took days collating past studies, public data and competitor insights now takes minutes. Teams can extract key insights and shape hypotheses for fast turnaround fieldwork, using proprietary AI tools to accelerate analysis, surface themes and apply frameworks.

At the centre are small expert teams building bespoke RAG (retrieval augmented generation) tools, trained on curated knowledge tailored to each client and challenge. These blend existing data, in-person research and sharp human thinking to deliver work that’s not just faster but deeper and more strategic.

Clients don’t just receive a report, they gain a reusable, AI tool that evolves over time. This opens the door to new models: from full service to ‘Done With You’ and DIY insight-as-a-service, shifting from billable hours to scalable, subscription-based licensing models to apply your agency’s thinking and approaches to data via API.

The strategic shift: From automation to augmentation

If the first wave of AI in research was about automation, the next wave promises augmentation: giving small, expert teams the ability to do the work of much larger ones and giving clients new outputs through the creation of custom AI tools and services.

From this perspective, rather than the rise of AI being an existential threat to the research industry, perhaps it’s simply an existential threat to the value equation our industry (and many other service-based businesses) has historically been based on.

What comes next is then an opportunity to build something better: work that is deeply human and that extends and enhances the very best we have to offer.

Rob Harrison-Plastow is founder at Source Nine Strategic Insights

We hope you enjoyed this article.

Research Live is published by MRS.

The Market Research Society (MRS) exists to promote and protect the research sector, showcasing how research delivers impact for businesses and government.

Members of MRS enjoy many benefits including tailoured policy guidance, discounts on training and conferences, and access to member-only content.

For example, there's an archive of winning case studies from over a decade of MRS Awards.

Find out more about the benefits of joining MRS here.

0 Comments