FEATURE1 November 2011

All MRS websites use cookies to help us improve our services. Any data collected is anonymised. If you continue using this site without accepting cookies you may experience some performance issues. Read about our cookies here.

FEATURE1 November 2011

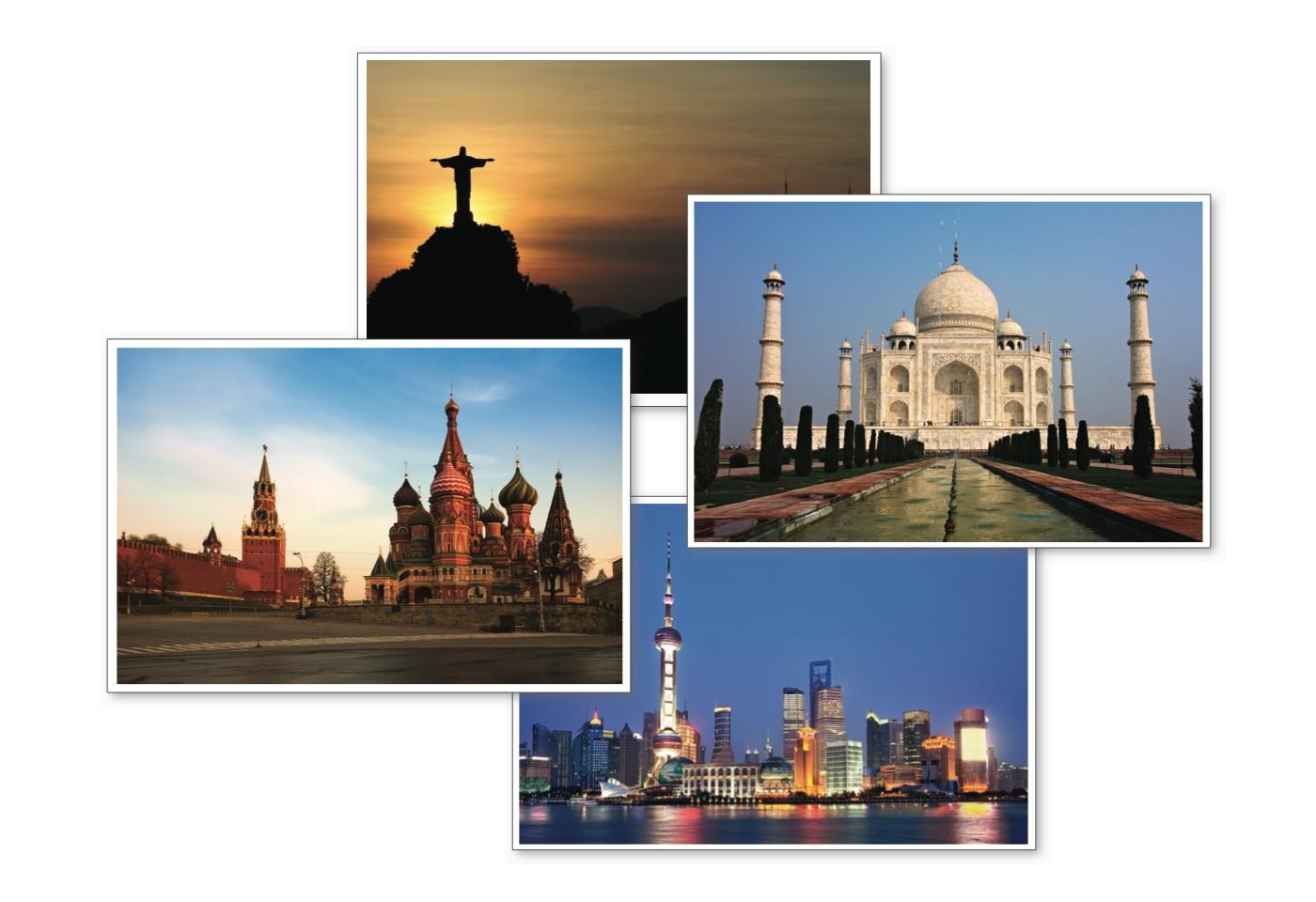

Market intelligence and research in Brazil, Russia, India and China – the ‘BRIC’ countries – remains tricky for those not familiar with the terrain. Four experts from Global Intelligence Alliance outline the challenges.

The fast-growing economies of Brazil, Russia, India and China (BRIC) pose unique challenges to companies seeking to gather market intelligence. We asked executives of the Global Intelligence Alliance (GIA) to share some advice on how to succeed in each market.

The common thread running through the BRIC markets is the rapid pace of change. Complex market structures, language differences, poorly enforced regulations and vast land areas result in diverse business cultures, grey markets and corruption.

“Things are changing rapidly in Brazil’s consumer, competitor, regulatory and economic spheres”

Thomas Rideg, ex-regional director, Latin America, now working in Hong Kong

Thomas Rideg on Brazil: Things are changing so rapidly in Brazil’s consumer, competitor, regulatory and economic spheres that companies need intelligence to maximise opportunities and minimise risks. Understanding what, where, how and why things are happening is impossible at a distance – it requires daily market monitoring at a very local level with knowledgeable sources. For example, in September the government quadrupled the tax on imported cars. Some importers managed to sort out paperwork at the port of entry enabling their vehicles to enter the market at the old tax rate – but those who were not alert to this will be facing some big problems.

Alexander Pechersky on Russia: Russia has high levels of bribery and a centralisation of power, finances and decisions in Moscow. The increasing role of government in the economy means that it is necessary to study government plans to invest, buy assets in your industry or provide support programmes to your competitors. In Russia it’s possible to buy financial information such as balance sheets or profit and loss statements on every type of company – but the data will often be inaccurate because of creative accounting to avoid taxes.

Peter Read on India: India is unusual in combining relatively well-developed educational, intellectual and English-language capabilities with the classic chaos and corruption of a large emerging market. While the domestic market remains complex and difficult to penetrate, there is no lack of talent available to take on the task, partly because India has emerged as a market intelligence outsourcing hub, handling research and information on any number of markets around the world.

“It is extremely challenging to find professional market intelligence talent in China”

Nicolas Pechet, MD, China

Nicolas Pechet on China: China’s marketplace is complex. You will find high levels of industry fragmentation, rapid consolidation, convoluted joint-venture structures and an extremely dynamic regulatory environment. The size of the country, uneven distribution of wealth and development and the diversity between its regions mean that any attempt to conduct market intelligence in China should start with the assumption that it comprises several markets, each of which needs to be understood to get a complete picture.

The sources of information in Brazil, China, India and Russia are peculiar to each country and influenced by local government and culture.

Rideg on Brazil: Access to published sources of information in Brazil varies from industry to industry. Some industries are very advanced and publish good material, while others have nothing. At the same time internet penetration is very high and there is plenty of information available online, but it’s important to be able to differentiate the reliable from the unreliable.

Brazilian organisations and multinationals can be more centralised than those in Europe and the US, so it is usually important to go further up the organisational ladder to extract valuable intelligence. It is important to speak to several sources to verify results and reach meaningful conclusions.

Pechersky on Russia: There is a general lack of ready-made reports, statistical data, industry associations and magazines in Russia. The common use of cash, grey customs operations, tax avoidance and bribery compel companies to misrepresent data. This results in the need to cross-check secondary information and to conduct primary research with in-depth interviews. Some industries are so opaque that just locating the real decision-makers can be a challenge.

“Encouraging industry people to share information isn’t too difficult in India. the real challenge is cutting through the noise”

Peter Read, SVP, Asia Pacific

Read on India: Published information is in no short supply in India and much of it is available in English. The library network is developing and becoming increasingly well-connected via the internet. On the down side, publicly available information is often out of date because of the size and diversity of the country and the range of activities being tracked by government agencies – from the onion crop to mobile phone component manufacturing to consumption of powdered baby milk. Added to that is the use of unique Indian units of measurement and the financial year rather than the calendar year for statistics. In conducting primary research, encouraging industry people to talk and share information is often not too difficult. The real challenge is in cutting through the noise to identify the real signals.

Pechet on China: Information sources in China differ from one county, economic zone or province to another. Quality information tends to be unregistered or even considered classified – there are no universal standards and protocols. In some places, money can still be a taboo subject and families who own private businesses are not eager to disclose details. Information is often only available through networks of contacts. People in general are willing to be interviewed, especially with a small incentive. With some basic development of interpersonal relationships, they will talk with little concern about intellectual property or confidentiality. However, interviewees in China tend to overestimate things in order to create a positive impression.

Junior research staff are readily available in BRIC countries, but with few recognised training courses, market intelligence talent often needs to be groomed in-house. Of the four countries India has probably the most advanced local talent pool.

Rideg on Brazil: The development of market intelligence in Brazil is moving at a fast pace in terms of interest and a more moderate pace in terms of investment. Only a handful of small associations and forums exist, including the Competitive Intelligence Forum. Many large companies aspire to a structured market intelligence function, and have allocated one or two intelligence professionals, but have not really given any extra push. Many professionals still feel isolated in their departments, struggling to get the financial support from their companies to drive their functions to a higher level.

“The common use of cash, grey customs operations, tax avoidance and bribery in Russia compel companies to misrepresent data”

Alexander Pechersky, MD, Alt Research and Consulting – a GIA member

Pechersky on Russia: Most companies in Russia, except for the very largest ones, often do not see market intelligence as a distinct function or as part of their strategy. Local talent is being developed, but at a slow pace. There is hope that as the competition gets tougher more companies will set up professional market intelligence functions.

Read on India: Market intelligence in India is relatively well developed for an emerging market. Some multinational companies even use India as their regional or global market intelligence hub. In terms of ambition and capabilities, the larger local companies are not far behind the multinationals.

Nonetheless, the willingness for local companies to fund market intelligence programs still lags behind that of the West. While local ambitions and organisational structures may be more advanced than in the other BRIC countries, they still fall behind smaller globalising companies in western Europe and North America.

Pechet on China: It is extremely challenging to find professional market intelligence talent in China. Even those with at least four years of relevant experience lack the capabilities we might expect them to have. Fresh graduates do not have business sense and need to be closely supported.

Local companies tend not to understand market intelligence and require a lot of orientation. They often don’t know how to identify and define their needs, and often rely on vendor proposals to they can do the work in-house. There is hope that Chinese companies with global aspirations will lead the charge in the development of market intelligence. Companies with heavy government influence will develop at a slower pace.

0 Comments