OPINION4 April 2012

All MRS websites use cookies to help us improve our services. Any data collected is anonymised. If you continue using this site without accepting cookies you may experience some performance issues. Read about our cookies here.

OPINION4 April 2012

TNS director Stephen Yap reveals the information ‘eating plans’ of UK consumers. From ‘fast foodies’ to ‘carnivores’, he says it is important for brand owners to understand how people digest data.

We are living in an age of information obesity – or ‘infobesity’, to borrow from MRS Conference keynote Magnus Lindkvist. Consumers are bombarded with an unprecedented level of information thanks to the growth of digital media; an amount far beyond that which our brains can store and process. Information obesity (or data overload) affects all of us, but the way in which consumers deal with this threat varies markedly.

As researchers, we need to look beyond the data we analyse in our professional lives to consider the profound implications it is having on the consumers we study.

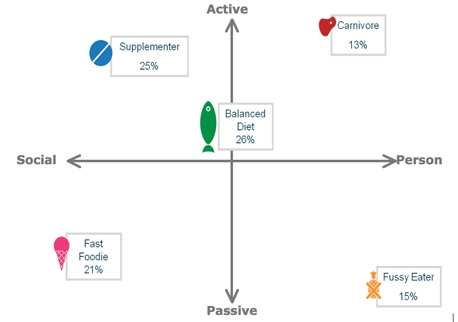

TNS have developed a number of new consumer segments, called ‘eating plans’, to give us a greater level of understanding of how people are responding to information obesity. The five segments are designed to help brand owners adapt brand communications to achieve cut-through among their target audience.

Fast foodies

To a consumer who fits the fast foodie profile, information provides social capital. A fast foodie craves tasty, bite-size morsels of information that are packaged for them to share. These people are generally social butterflies, whose peers look to them for clarity as to what’s going on.

Fast foodies are not interested in probing too deeply into information. They only desire information that enhances their inherent sociability.

This segment skews primarily towards women. Fast foodies are among the earliest adopters of technology, particularly smartphones and tablets. The primary use of technology is to enhance their sociability and as a result they are heavy social media users. Fast foodies are much less likely to consume print media such as newspapers or read books in print format.

Supplementers

Supplementers actively seek out all the information they can get their hands on. They are particularly attracted by information that is new and fresh. They share with the fast foodies the desire for information as social capital. Where they differ is that they want to be the person who discovers the information. They want to be the person that others go to for information.

Supplementers desire facts, but in capsule-sized chunks and delivered from credible sources. They love to disseminate this and share ideas with others. This makes them great communicators and influencers.

They skew towards the young, with 53% being under 35. They are the segment most likely to be smartphone and tablet users. These forms of technology facilitate their need to be first in the know. They are the heaviest users of online news, social networks and gaming.

This segment are less likely to read the Sunday papers and more likely to read magazines. Magazines offer them the balance between depth and breadth.

Carnivores

Carnivores are typically experts and authorities. They refuse to consume anything except the meatiest chunks of information. Like supplementers, the key to this group is the process of discovery. Carnivores use this to fuel their inward passion rather than as social capital.

Carnivores don’t cast their net wide when seeking information. They focus on a small number of sources that they consider worthy and about which they care deeply. They scorn lighter forms of information and have a honed ‘nonsense filter’.

People who fit this profile make great spokespeople and are very good at persuading others. There is some social element to their behaviour, which is to be seen by others as an expert.

Carnivores skew older with 81% aged 45 or over. They have less appetite for technology: they have evaluated digital mediums but will generally have decided that it doesn’t suit their needs. They love books and weekend newspapers which they read cover to cover. TV news and current affairs programmes are very important to them.

Balanced dieters

As the name of this segment suggests, balanced dieters are constantly looking for balance and harmony in the information that they consume. They deal with information obesity by relying on a set of trusted sources and choices, and try to maintain a healthy balance between the fun and serious, the old and the new. They make great managers and team builders due to their highly pragmatic nature.

They love TV and enjoy everything from documentaries to period drama, with The X Factor and game shows also thrown into the mix.

This segment tends to shy away from Twitter, Facebook and YouTube. They don’t really see the benefit but are happy to use Google and bbc.co.uk.

Fussy eaters

Fussy eaters are the Luddites of the information age. They long for a simpler time when life wasn’t so complicated. They feel that social media is degrading the very fabric of society. They seek just enough information to survive and are very sensitive to change.

Unsurprisingly, fussy eaters skew older: 78% are aged 45 or above. They are the least likely of all the categories to own a smartphone or tablet computer. Similarly, they are least likely to research purchases online, shop online or use online banking. In fact they prefer to avoid any online activity and are even limited in their newspaper usage, sticking to a single quality weekend paper.

As a result of this closed existence, fussy eaters are not sure where their interests and passions lie. They need to be dragged kicking and screaming into the modern world.

The eating plans demonstrate that information obesity is polarising the population in terms of how they process information and consume media.

The graph below illustrates the two crucial axes that define peoples’ response to information obesity. The social/personal axis refers to whether people’s consumption habits are based on social needs or personal needs. The active/passive axis refers to whether people are actively seeking out information or allow the information to find them.

The graph also indicates what percentage of the UK population falls into each eating plan, based on our research (click image for larger version).

Stephen Yap is a group director in the technology department at TNS UK

Author’s note: These segments were first identified through a qualitative study which highlighted five different consumer ‘eating plans’ based on how individuals consume information both on- and offline. In addition, a quantitative analysis based on the results of both a face-to-face omnibus and an online survey (with nationally representative samples) validated the segments and helped us to understand more readily the key segments consumers fall into, when they consume media.

7 Comments

The Researchist

12 years ago

Dear Stephen, Fantastic article! This information is especially important as more and more consumers are 'sharing' information across online networks and social platforms. It will be interesting to see how people digest the surfeit of info being shared. It seems, at present, there are a lot of 'fast foodies,' but I think the most meaningful dispersal of information does, and will, come from info curated by the 'carnivores.' Potentially, a place for MRX to shine, too; quality analysis, instead of strictly quantity when it comes to data. Especially as digital mediums threaten to dominate virtual quant surveys, etc. Discovery is key here: how do we get the 'carnivores' or even the 'fast foodies' to discover (and consequently share) quality information online? I think this answer will be of the utmost importance to the MRX industry. Thanks so much for this! Sincerely, Katie The Researchist www.theresearchist.com

Like Reply Report

Sue Cardwell

12 years ago

Love the metaphor! Some salient points here for those of us who deliver data - I'm thinking of our clients rather than the population as a whole. I think we would also see some interesting things in terms of the kinds of information the segments prefer, e.g. there are those of us who just love the detail for its own sake, then there are those of us who are impatient for the bottom line - the positive or negative impact on me.

Like Reply Report

Matt Jonas

12 years ago

I think the article hits on an interesting point - how people consume and react to information. The food metaphor may have been laboured a bit too much though! Be interested to hear how the segmentation was developed too? On the subject of the concluding graph, fussy eaters have been put as the most passive segment. Surely, someone who actively chooses not to engage with information is not passive?

Like Reply Report

Peter Shreeve

12 years ago

Information digestion will differ by the traits you describe (there are lots of relevant points in your work) but they will also differ by the topic and buying category of interest and the financial risk of making the wrong decision based on the information consumed or shared. In cases where expert advice is required the internet may be discarded for a face to face meeting e.g. Both Fussy eaters and Fast foodies might go to their local bank even if Fast foodies bank online. Understanding the importance of the conversations consumers have in branches/shops is pretty critical in managing service brands. In turn, Fast foodies and Supplementers might also look to the older and wiser Fussy eaters for advice on house buying and pensions. Hence it should be recognised that conversations are two-way with one party dominant in one situation and less so in another, depending on the topic of conversation. www.peter-shreeve.co.uk.

Like Reply Report

Frank Parisi

12 years ago

Good topic but Context is everything. The key issue is how individuals assemble and re-assemble their subjectivist information repertoires around themselves. Frank Parisi FPRS www.fprs.co.uk

Like Reply Report

Johan

12 years ago

Thanks Stephen for this interesting article. I think advertisement and the masses of information that gets thrown in our face today, makes ur more 'fast food' oriented. When Im using facebook or google my eyes are automatically filtering out information that is fast and easy to understand. Stay great Johan http://www.surveylegend.com

Like Reply Report

Stephen Yap

12 years ago

Thanks everyone for the comments! @Katie: having presented this thinking to a wide variety of clients we have seen how it could be utilised in different ways – ranging from creative and campaign optimisation, to internal information dissemination within organisations. I agree that there are important implications for the MR industry in the age of big data – with clients and brands overwhelmed by information, successful MR is increasingly dependent on cutting through the clutter. @Matt Jonas: the active/passive axis refers to one’s orientation in terms of information discovery. For Fussy Eaters new information and ideas have to discover them rather than vice-versa, hence their skew towards passive. @Peter @Frank: there will inevitably be some contextual skew in terms of the eating plans, and like any segmentation thinking this should ultimately be activated through a category lens. However we have observed that people exhibit a fundamental orientation to information that serves as a core defining characteristic independent of category or touchpoint.

Like Reply Report