FEATURE1 July 2009

All MRS websites use cookies to help us improve our services. Any data collected is anonymised. If you continue using this site without accepting cookies you may experience some performance issues. Read about our cookies here.

FEATURE1 July 2009

A new survey of the Asian research market suggests initial views of the downturn’s impact may have been a little over-optimistic. But while spending is down, it’s an open market for agencies with the right stuff.

?What’s the role of research in clients’ planning amid the economic downturn in Asia? How are practices for procuring and using research changing? And how are the leading agencies in the market perceived?

In April 2009 Asia Research conducted its second annual survey of corporations that use external agencies for market research, covering a range of industry sectors, primarily in south and south-east Asian markets. Here is what they found.

When asked whether senior management see a need to invest more in market research or commission less to save money during a downturn, 14% of clients said ‘invest more’ compared to 40% saying ‘commission less’, with the remainder saying it depended on the situation. For some companies, especially those not in the FMCG business, research is seen as ‘nice to have’ but not essential. Common feedback was that research, although important, can simply wait a year. Some even commented that it is difficult to obtain an immediate return on investment in research and that, even if the research identified opportunities, the company might not be in a position to take advantage of them because cuts in other infrastructure have already been made.

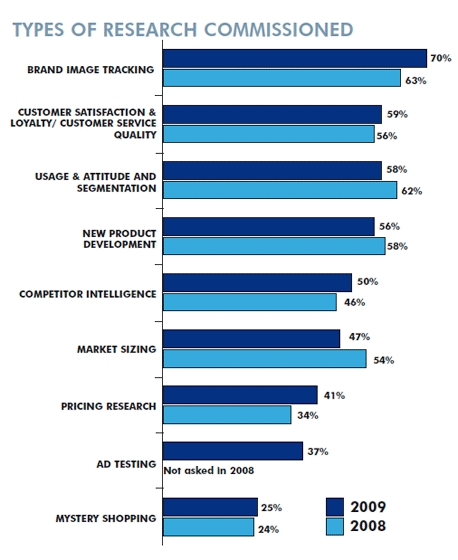

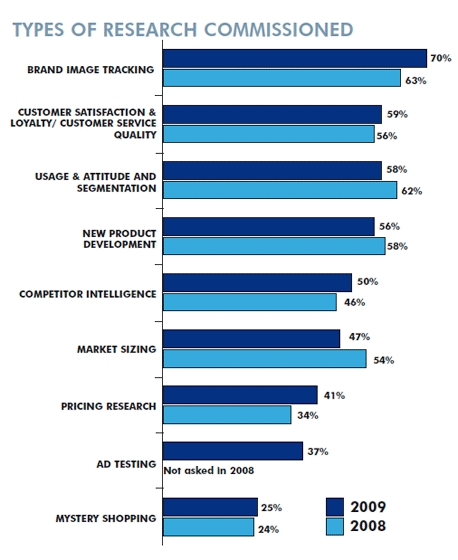

Areas of research that are more important to clients in 2009 compared to the previous year include pricing and customer satisfaction research. The ICT sector in particular is undertaking more pricing research as well as competitor intelligence.

But the bedrock of the industry is still brand image tracking. This was the most common type of research being undertaken in both 2008 and 2009. Generally the view from clients is that if there is pressure on research budgets, their corporations are likely to commission less ad hoc research compared to trackers.

More bang for your buck

As a result of lower budgets, corporations are trying to get a lot more research for their money (echoing a trend seen in Virtual Surveys’ client survey in the May issue of Research). One of the more common practices used to achieve this is to undertake fewer projects but to try to get more information from them. This is most evident in the automotive, financial services and public sectors.

There are also changes to the methods used by clients to procure research. For example 42% of corporations are seeking more tenders. This is even higher in the public sector where open tenders published online are a common practice. However, more commonly it’s down to negotiation – 76% of corporations say they will negotiate more on price, and a third state that they might reduce the number of agencies they use in order to get preferential rates within a smaller portfolio of preferred suppliers.

Another common practice is to save cost by undertaking more research in-house. This is more likely among management consultancies that have traditionally outsourced the data-crunching parts of their projects but are now doing it themselves. More use of syndicated research is another tactic to reduce costs, especially within the automotive sector.

The supply market

Similar to other industries that move into a sharp recession, over-supply is now a problem in the research industry. This is probably most acute in Singapore – one of the region’s most important research hubs - where over 40 different suppliers are used. The market is led by the big agencies including Nielsen, Synovate, TNS, and Research International. But, compared to 2008 their market position is not as dominant, with many of the second-tier suppliers now very close behind, including Kadence, Saffron Hill, Ipsos, Insight Asia, and new entries to the higher rankings this year including Idealog, BDMI, and Harris Interactive.

It’s an open market

One of the more significant findings from the survey was the openness of the market to new research agencies. About 70% of corporations are open to considering new suppliers including 28% stating that they are ‘very open’. The sectors most open to new suppliers are the automotive and public sector, although the latter is generally seeking suppliers on an open tender basis anyway. When picking new agencies, there were a few key things clients told us they were looking for:

Although clients are open to considering new suppliers, whether business is actually placed with these agencies will depend on their value proposition. The survey addressed in detail what clients looked for in a new supplier and the factors that would sustain repeat business with a supplier going forward (see box overleaf). Fieldwork quality and sector expertise were among the most mentioned factors, and the variety of results illustrates how much the industry needs tailored services to meet clients’ requirements.

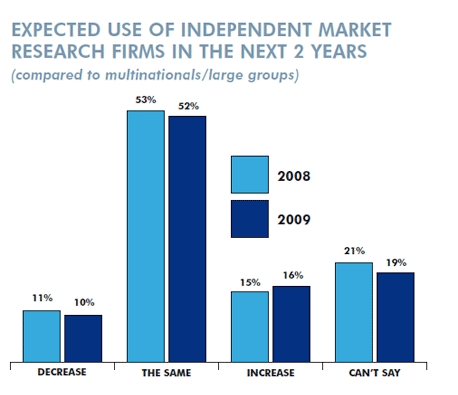

The average number of agencies used by corporations is about three. On balance there will be no net increase. However, with such an open market there is likely to be quite a lot of hiring and firing of agencies within a client’s portfolio. There is a tendency for clients to switch to smaller firms, with 16% stating that they might use them more in the future versus 10% stating less. This finding is similar to 2008 and indicates that the industry will continue to fragment.

There is also interest in engaging the services of very small independent consultants, e.g. those working from a small office or home office, where clients feel that they can bring more value through more involvement of senior staff in the research and more sector specialism. Many also see that using such consultants could offer them significant cost savings, which in the current environment would be most welcome.

Conclusions

Evidently the research business in 2009 is shrinking, with Singapore being one of the hardest-hit areas. Several firms report redundancies. The pressure on budgets means that research buyers are becoming more skilled in the art of negotiation. As has been seen in many business-to-business markets, these skills might be carried through into the recovery meaning that pressure on margins could impact research agencies for some time.

But, there is still a reliance on traditional research such as brand trackers, which are often expensive, but do not necessarily inform the client on how best to realign their service, product or offering – a question that would be better answered through ad hoc research which many clients are cutting. It would be very disappointing for the board of directors to invest in research in 2009 that tells them their market share and brand perception have not changed since 2008, and to have no road map for how to improve these in 2010.

Quite rightly, clients recognise that data collection quality is paramount in choosing a supplier. But pressure on pricing often means that agencies and management consultancies might buy from the bottom of the market. Many of the larger agencies who have spent perhaps two decades developing their fieldwork quality control systems are now throwing all this away by outsourcing their data collection to external fieldwork suppliers with very basic quality control.

The depth and breadth of the global recession are fundamentally changing customer attitudes to branding and how they evaluate products and services. Probably one of the biggest opportunities for clients is to have first-mover advantage with consumers and business customers on the recovery. With perhaps less pressure on budgets in 2010, and a need for corporations to totally rethink their product and corporate communications strategy, the prospects for the research industry in 2010 should be brighter, especially considering that some corporations are postponing some research from 2009 to 2010. But nothing is definite. In last year’s survey, 45% of clients stated that they expected their organisations to spend more on market research the following year. How wrong they were.

“Those [research projects] that are not so critical on our business trend, we will have suspended for the year.” “Information is needed to make the right decisions in our operation so market research projects are not cut.” “In times of economic downturn, [research] is one area our management will look into reducing the budget.” “If we can do in-house research, we will do it and try to reduce and cut down the costs of research that way.” “Money has been channeled into other marketing activities such as product launch and communication development.” “The traditional methodology is definitely more costly but nowadays with the penetration of mobile phones and internet, similar kinds of studies can be done at much lower cost without compromising on the robustness of the research.” “We have to understand our market much more than before… and make important business decision with facts rather than through guesswork.” “Research is pretty important… we can actually capture markets that we have not explored yet, it is an opportunity for us to expand.” “We think it is OK to skip a year [on research].”

Reasons for spending more or less in recessions

The results of this survey first appeared in the Q2, 2009 edition of Asia Research. ?The survey was undertaken by telephone among individuals in corporations who commission research agencies and are involved in dealing withthese agencies throughout the project cycle. Two hundred individual research buyers were surveyed across five Asian markets. All participating companies had engaged at least one agency in the last year, and together theycommissioned an average of five projects a year.

0 Comments