FEATURE30 July 2012

All MRS websites use cookies to help us improve our services. Any data collected is anonymised. If you continue using this site without accepting cookies you may experience some performance issues. Read about our cookies here.

FEATURE30 July 2012

The Olympics provides an unparalleled opportunity to study cross-media viewing behaviour. NBC Universal’s Alan Wurtzel takes us through his billion-dollar research lab.

The eyes of the world have turned to London as hundreds of millions of people tune into the 2012 Olympic Games. It promises to be a spectacle of sporting prowess. But for a couple of dozen research geeks at NBC Universal 27 July wasn’t about sport at all. It was the beginning of the Billion Dollar Research Lab – a unique opportunity to measure how the Olympics are consumed and, perhaps more importantly, to catch a glimpse of the future of media.

What makes the Billion Dollar Olympics Lab a unique research opportunity? For starters, we have a huge amount of content available across four platforms: TV, PC/internet, mobile and tablets. That content will be consumed in enormous quantities – whether it’s TV ratings, unique visitors or page views, Olympic consumption dwarfs every other media event. Meanwhile, unlike other big TV events like the Super Bowl or the Academy Awards, the Olympics takes place over 17 days so it’s possible to see trends develop and behaviour change.

All of this results in an acceleration of consumer media behaviour and increases the measurement effect. We can study consumer media behaviour in ways which just aren’t easily measureable under ordinary circumstances. In sum, the Billion Dollar Lab lets us see the future – the future of consumer media behaviour and equally important, the future of measurement.

To offer a sense of the enormity of the measurement task, consider this: the London Olympics will be seen on two broadcast networks – NBC and Telemundo – and four cable networks – NBC Sports Channel, CNBC, MSNBC and Bravo. There will be a total of 835 hours of programming – that’s an average of 49 hours each day – and over 16 hours every day on the NBC network alone. On digital platforms we will have over 3,000 hours of livestreaming on our Olympics website (nbcolympics.com) and over 3,200 hours of live streaming on mobile and tablets.

Ready for primetime

London will be our third lab, the first being for the Beijing Games in 2008. What we learned then was that TV is king; that regardless of newly-emerging platforms TV remains the dominant way people consume Olympics content. We found that digital content complements television and actually increases its use. We found that those who used both the internet and television watched significantly more TV than those who watched the Olympics only on TV.

When it came to cross-platform distribution – and at the time there were just three: TV, PC/internet and mobile – we found we were able to measure it. We could produce true “single source” data where one person generated data about TV, internet and mobile consumption.

The use of digital platforms increased interest among younger viewers – something that had been diminishing in previous games. But we found that mobile just wasn’t ready for primetime. The iPhone had been released only a year earlier and there was minimal smartphone penetration.

Two years later, at the Vancouver Winter Olympics, TV remained king, though the use of internet and mobile had increased and become mainstream. Fully one-third of Olympics viewers engaged in some sort of simultaneous media use during the games.

The increasing use of digital content resulted in heightened interest among younger consumers. Viewing among people aged 18-24 grew by 49%.

As we move on to London we will be looking at these research initiatives:

With the use of cross-platforms growing, we expect to see more users and more mainstreaming – and with it the rise of the “simus”: the simultaneous media user. We think they will play an increasingly important role in how media is consumed in the months and years to come.

Changing face

Cross-platform measurement has changed much in the four years since Beijing, when three-platform distribution was just beginning. At the time, we were able to produce single-source ratings using a proprietary audio recognition methodology developed by iMMi. This featured a phone that could recognise audio signatures from TV Olympics content and link it to the individual respondent. iMMi software also measured mobile use – such as it was in those days – and a software meter on the PC produced internet measurement, but only for the nbcolympics.com website.

In total, we were able to measure 40 “Olympics enthusiasts”. It was the research equivalent of the Wright brothers’ first flight: primitive and limited, but it worked and showed we could produce single-source cross-platform data in the real world.

Two years later, in February 2010, cross-platform advanced and so did our ability to measure it. We increased the number of websites we could measure from one to 47 giving us a much more multi-dimensional view of the internet. We also partnered with Arbitron to develop the first truly in-the-field two-screen measurement – TV and the internet – which could be generalised to a larger population.

For London, we are partnering with ComScore and Google. The ComScore study will provide single-source, passive and self-reported measurement both in and out of home. They will provide this data using a panel of 750 “tech-forward” Olympics enthusiasts. We recognise this may not be nationally projectable but we want to do everything we can to ensure we are measuring Olympics consumption without incurring any empty research calories. The panellists will be recruited from a population of set-top-box-owning households and their viewing data will be augmented with a self-reporting electronic diary so we can apply demographic information to the set-top box viewing data. The self-reporting diary will also enable us to measure out-of-home viewing on all devices.

Together, this should give us a day-in-the-life measure that takes us far beyond what we could do in Vancouver. The sample will be more than ten times the size of earlier Olympics enthusiast panels, allowing for a deeper dive on a variety of demographics.

Meanwhile, the partnership with Google takes a somewhat different approach. Google will be recruiting approximately 3,000 panellists and will use totally electronic, passive measurement for all platforms. This includes a TV meter which is wired to the set to capture all TV viewing and with it the demographics of those watching. Panellists will also have a special router installed configured by Google to capture all online usage from PCs, cellphones and tablets in the home.

We will supplement the Google and ComScore studies with a “Total Touch Self-Reported Panel Interview” project conducted by Knowledge Networks.

We will speak to 500 Olympics viewers daily and use this nationally representative panel to help us understand both behaviour and attitudes towards cross-platform consumption in and out of home. We’ve used this approach since Beijing so it offers an opportunity to track changes as they occur over the years.

Out-of-home viewing is an important part of the Olympics and Arbitron will again be measuring what people watch while out and about using its portable people meter (PPM) device. 69,000 PPMs are already in use in the US, measuring radio exposure in 44 of the country’s media markets. During the Games the devices will record exposure to NBC’s broadcast and cable content.

Meet the SIMUS

Cross-platform consumption encourages simultaneous use of different media and the growth of a new type of media consumer – the aforementioned “simus”.

We first saw this phenomenon emerge during the Vancouver Games, where one-third of people who consumed Olympics content were simus. And they were pretty evenly divided in terms of age and gender. Over half of all mobile WAP and app users were simus.

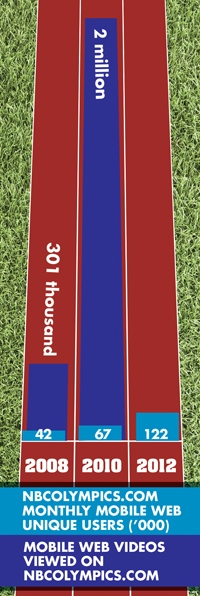

“In Beijing users viewed over 300,000 mobile video streams. Two years later in Vancouver that number increased over 500% – to two million streams. In fact, Vancouver’s mobile use eclipsed Beijing’s after only three days”

Unquestionably mobile use has grown significantly in the run-up to the London Olympics. From 2010 to 2012 the number of mobile users grew by about 5% but that’s because handset penetration is almost universal. The radical change has been in the growth of smartphones, which enable true video viewing on a handset. During the 2010 Vancouver Olympics, smartphones accounted for about 26% of all handsets. That number will almost double to 45% when the London Games begin.

The growth of mobile video has been tremendous. At Beijing users viewed slightly more than 300,000 video streams. Two years later in Vancouver that number increased over 500% – to two million streams. In fact, Vancouver’s mobile use eclipsed Beijing’s after only three days.

During Beijing, 15% of users age 50+ consumed Olympics content on their mobile device. Two years later during Vancouver that number almost doubled to 27%. Another way to look at it is that 7 out of 10 Vancouver mobile users never used mobile during Beijing.

Our research on mobile during Vancouver predicted the growth of the app as a content delivery device. While it may seem obvious today, back in 2010 this was a new and significant insight. We expect the use of the app to grow further during the London Games. Back in July 2008 there were only 800 apps available on the iTunes store. By Vancouver that had increased to 240,000. Today Apple offers over half a million apps.

Talking points

Finally, our research will look at social media – without question one of the fastest-growing, most interesting and least understood of contemporary media behaviours. Our measurement of this channel has certainly evolved since Beijing.

In 2008 the best we could do was to track online conversations about the Olympics but that was primitive. Two years later, during Vancouver, we measured word of mouth about Olympic advertisers and we were able to identify visits to various social media sites. Our social media measurement will be much more sophisticated for London, though. We will be able to track activity and trends in individual sports, athletes, topics and issues as well as conversations around our major advertisers.

BlueFin Labs will provide us with data on the social media conversations surrounding the broadcasts, the athletes, the sport, and the commercials. Meteor Solutions will attempt to understand the power of social media influencers, where they go, and how and what content they share. We hope to understand how influencers work inside social media and how we might be able to leverage their activities for both programming and sales.

And speaking of sales, not surprisingly we need to figure out how we can pay for all this Olympic content. A significant part of our sales effort is to provide advertisers with tangible research measures of advertiser effectiveness. In other words, we need to give the advertisers a return on investment to justify the cost of their Olympic spend.

In Vancouver one of the most powerful demonstrations of advertising’s effectiveness was provided by an initiative we developed with Google. We graphed the Google searches which occurred after a commercial had been broadcast. In one case the advertiser was the British Columbia tourist board, and we saw searches on Google spike immediately after their commercial hit. I don’t know a more compelling demonstration of the direct relationship between exposure and behaviour than this methodology. We plan to do a lot of this sort of work during the London Olympics.

That’s how my colleagues and I will be spending our summer vacation: working on the Billion Dollar Olympics Lab and attempting to see the future. I hope this brief overview conveys the breadth and depth of the research initiatives we will employ. Researching contemporary media behaviour using the Olympics is a unique opportunity which only occurs every two years so we are determined to make the most of it.

Alan Wurtzel is president of research at NBC Universal

1 Comment

Anon

12 years ago

It's good to see someone thinikng it through.

Like Reply Report